Data is a critical asset for any business to aid decision-making and increase profit and operational efficiency. The legal sector more than any other deals with significant amounts of confidential data which needs to be protected while remaining accessible to clients directly.

Data could bring as much as £3 billion in profit from increased productivity. However, many law firms currently do not prioritise data transparency and governance in their practice management systems: according to research from LawtechUK, only 20% of solicitors in England and Wales feel that their organisation captures data effectively.

A data-driven approach is also essential to avoid risk in the digital age, particularly for law firms that have to manage both on-premise and cloud data. Additionally, data analysis can help improve legal processes, practices and products. Implementing a data governance framework is key to achieving this.

This insight details the advantages of building an effective data governance framework aligned with business objectives, highlighting the importance of achieving data maturity in the legal sector to improve services and increase profit, leveraging key tools such as client portals.

What is data governance?

Data governance is the process or group of processes used for managing enterprise data to ensure usability, access, security and integrity. The process is defined by internal policies to control data usage. Effective governance ensures that data is protected and consistent.

In law firms, an effective data governance strategy is essential to address the challenges of digital transformation. Because the legal sector has been slow to incorporate new technologies in its processes, companies often deal with a mixture of paper records, and on-premise and cloud data that can be difficult to organise and protect. Without a data governance framework, organisations are exposed to potentially costly regulatory risks, which can result in losing credibility and clients.

Data governance and client relationships

With the rise of technology in a variety of industries, clients have come to expect immediacy in the access and delivery of services. Clients now have unprecedented leverage over service providers, and this applies to the legal sector too. In most cases, clients are discerning about the competition on the market and have a clear idea of their requirements and expectations. They want to be in control of the service they are getting, which means having data transparency and easy access.

Effective use of data shows clients that firms have a competitive advantage over others: companies leveraging technology and data have the upper hand, ensuring faster service, improved accuracy and cost-effective rates.

For example, research by Legalease Research Services, published by Legal 500, shows that one of the main reasons for client dissatisfaction is the lack of transparency on law firm bills. In the last two years, satisfaction with billing transparency has decreased by 1% among clients of UK law firms. Reported pain points included failure to provide work-in-progress reports, itemised billing by lawyer’s name, rates and reasons for the fee in each invoice.

The use of data-powered technology would allow for process automation, producing accurate quotes, itemised bills and regular communication about fees and costs. Ultimately, digital solutions allow law firms to have a one-to-one relationship with their clients, earning their loyalty by improving operational efficiency and therefore increasing profit. A data governance framework is fundamental in order to implement these practices effectively.

Developing a data governance framework

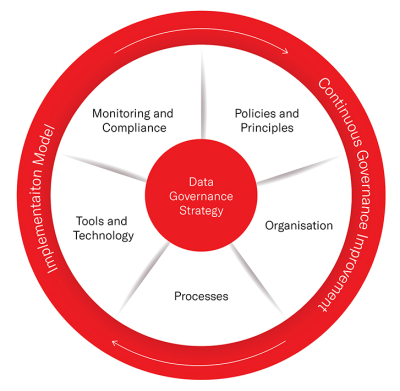

Thinking about the organisational structure is the first step to developing a data governance framework. What are the policies and principles guiding data management processes and standards? Who is responsible for ensuring these processes run smoothly? Here is our example of the data governance framework for continuous and cyclical organisational improvement:

- Policies and principles – Policies are usually business statements defining the company’s responsibility and what can and cannot be done. Principles are regulations aiming to enforce data management standards and guide decision-making within steering groups. Together, they constitute the core of a good data governance framework. Policies and principles should be designed with operational efficiency in mind, creating a unified vision based on transparency and a defined purpose.

- Organisation – A clear company structure is essential to applying the framework. Clearly defined roles and responsibilities allow for smoother processes and decrease the chances of data being compromised.

- Processes – In order to leverage accurate data across the company and allow clients to access their data securely, specific internal processes need to be put in place, defining how data is created, modified and maintained.

- Tools and technology – A data governance roadmap that aligns with business strategy and goals helps implement the right technology to adhere to data management standards. Software, data models and high-level architecture ensure processes and policies are put into practice, improve operational efficiency and increase profit.

- Monitoring and compliance – The final step is implementing a solid structure to mitigate risks and ensure compliance with current regulations. This includes defining Key Performance Indicators (KPIs) to evaluate the effectiveness of the data governance framework.

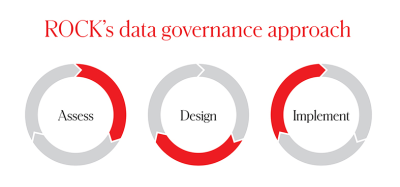

We approach data governance by assessing, designing and implementing a strategy tailored to different business needs in the legal sector. With an assessment, companies can understand the current state of their data governance policies and strategy, identifying areas of improvement.

Many organisations will have elements of a data governance strategy already in place. The design process builds on existing structures to create the most appropriate and efficient solution. The third and final step is making sure that the data governance strategy is successfully implemented across the company, bringing tangible benefits.

Data governance in practice: the rise of client portals

One of these tangible benefits, as we mentioned, is better client services resulting in improved operational efficiency. Over the past decade, law firms have achieved this by investing in client portals. Client portals have now become an essential tool to retain clients and remain competitive.

In fact, a client portal provides additional security, enhancing companies’ existing data governance strategies. A web portal enables lawyers to stop relying on paper records and postal delivery of confidential documents, and clients can upload, sign and share documents via encrypted solutions, in line with the law firm’s data management policies.

Additionally, client portals provide a centralised location for confidential data including documents, bills, communications and client updates, facilitating collaboration in a protected digital environment. These solutions are scalable and designed to consider the rise of remote working and the potential to reach clients beyond a specific local area.

Finally, by enhancing the quality of service, a client portal can help increase profit and convey a positive image of firms that are open to innovation and change while remaining client-focused.

Lawtech software for data governance

Lawtech software is set to revolutionise the legal sector. According to research by Tech Nation (LawtechUK), the UK lawtech sector is growing at a rate of 101%, outpacing even fintech and healthtech. Effective software solutions are key to the implementation of data governance and business strategy.

Some of the most common features of data governance software include machine learning and automation to:

- Speed up repetitive processes using predictive models

- Quickly find datasets

- Collaborate with different clients and departments in the cloud

- Share and govern the analytic workflow processes, models and data

- Schedule automated reporting and outcomes.

“Making the best choices for your business requires a deep understanding of your industry, which can be a complex and evolving terrain to navigate. We understand the need for a strong roadmap, industry-specific solutions, tools and trustworthy partners to transform your business and drive those core outcomes throughout your enterprise. ROCK is a technology leader in digital transformation, with the expertise to get your legal practice and organization ready to succeed”. – Nicky Griffiths, Business Development Representative at ROCK.

Conclusion: the future of data governance in the legal sector

Despite lawtech being one of the fastest growing industries in the UK, law firms have been slow to adapt to technological innovation. Being able to access services through digital technology has become essential for clients, so organisations have to harness the tools to stay competitive.

Understanding the value of data and implementing an effective data governance framework is the first step to meeting clients’ expectations. Client portals have proven to be an exceptional tool for managing relationships with clients, improving operational efficiency and increasing profit. But without a framework establishing regulations and roles for data management across single organisations, client data could be compromised and firms could face regulatory risks.

Going forward, data will continue to generate significant opportunities for growth, which is why better policies and regulations are needed to support the adoption of emerging technologies encouraging a collaborative approach in the legal sector. Internal data governance is essential, but it is only the beginning.

References

- Gower, D. (2021) How law firms can better manage their data. The Law Society 14 October 2021. [Accessed: 19 October 2022]

- LawtechUK (2021) The LawTechUK report 2021: Shaping the future of law. LawtechUK 14 May 2021. [Accessed: 17 October 2022]

- LawtechUK (2022) LawtechUK and the Open Data Institute launch Legal Data Vision. LawtechUK 2 March 2022 [Accessed: 17 October 2022]

- Phillips, J. (2022) Breaking down barriers: client behaviour in the digital age. Fivehundred magazine. [Accessed: 19 October 2022].

- Pritchard, B. (2021) Clients want clearer bills. The Legal 500 Data Blog 6 May 2021. [Accessed: 18 October 2022]

- Tech Nation (2021) UK lawtech opportunity valued at £22bn, report finds. Tech Nation 15 July 2021. [Accessed: 20 October 2022]